The Halving Happened, What Happens Now?

The 2024 Bitcoin Halving has officially occurred.

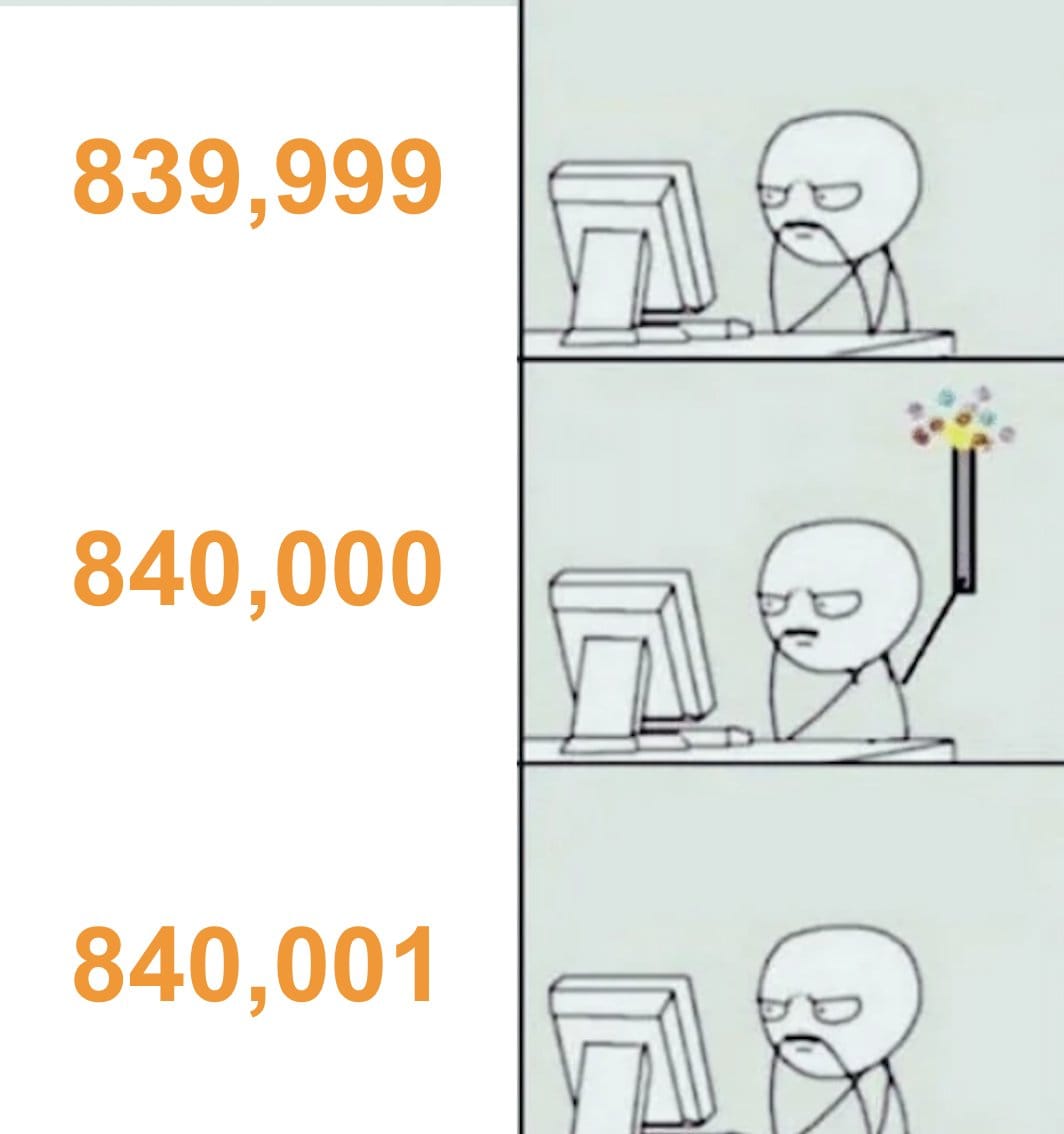

The mining reward instantly switched from 6.25 Bitcoin to 3.125 Bitcoin as the blocks moved from block number 840,000 to the next—the result of a mechanism written into the code reviewed and audited by thousands of people. Roughly every 4 years, this pattern of behavior will repeat until all of the Bitcoin is mined by the year 2140. This is standard protocol.

So, what does this year’s halving mean for Bitcoin?

With the mining reward cut in half, Bitcoin’s stock-to-flow ratio is doubled, ensuring it is permanently more scarce than gold, making it the hardest asset in the world.

Institutions that have been gobbling up thousands of Bitcoin a day with their Spot ETF products now have a daily issuance supply shock on their hands as the total new Bitcoin mined every day moves from 900 to 450.

After the block was mined causing the halving to occur, Bitcoin continued to mine the next block. It operated in the same way it has since its inception. The next block was mined, there was no downtime, and the protocol continued. Tick Tock, next block.

Understanding and accepting Bitcoin and how it works in this way is a superpower because you can tell the future. You can approximately predict how many blocks will be mined each day, when the next halving will occur, and what the rewards for all of these blocks will be. There is no cause for doubt when looking at Bitcoin’s monetary policy.

To summarize, the Bitcoin halving makes it the hardest asset in the world, traditional financial institutions now have the supply of daily new Bitcoin they can access cut in half, and the Bitcoin network will just “keep on keepin’ on.”

But for me and you, what happens next?

The halving is an exciting time and the price after the halving has historically soared to new heights, but this price action doesn’t occur overnight. It takes time for the supply shock to occur. Expecting Bitcoin to suddenly increase in price is not historically accurate and will most likely cause you to have false hopes. If anything, the price of Bitcoin could slump because of how much the halving has been a focal point of discussion and people could “sell the news.”

If we look at the data, the price of Bitcoin has risen 19.03% in the month leading up to the halving and only 1.70% in the month after.

But don’t let that stop you from celebrating the halving–an event 4 years in the making marked by extreme highs and extreme lows within the industry. So celebrate, just don’t run away when the price doesn’t immediately skyrocket.

My personal take on what happens next is largely nothing.

I don’t think anything will happen over the next couple of days or even weeks. But that doesn’t mean the potential energy isn’t building. Compounding days where half the amount of Bitcoin is being newly mined matters, it just takes time. I believe as institutions continue inhaling all of the Bitcoin they can get their hands on, there will reach a point, suddenly and abruptly, where the Bitcoin on the open market causes an extreme supply shock. When this happens, we will reach new heights.

Historic data tells us that prices a year after the halving are far different than when the halving first occurred. Bitcoin has risen on average 3,224% in the year after the halving. While this average is skewed by the monstrous 8,839% return in 2013 following the 2012 halving, it is undeniable that returns have been higher post-halving compared to pre-halving on each of the three examples we can pull information from. I expect this pattern to follow suit until it doesn’t. In this case, I expect price increases sooner because of the external circumstances that weren’t a factor in previous cycles–mainly Wall Street adoption.

With institutional demand here, the laws of supply and demand do not change. If there is more demand than there is supply, the price increases, it is elementary math.

My advice to you is simple: lower your time preference and imagine what the price of Bitcoin and all of the potential outcomes for the overall industry can be in 12 to 18 months. The day-to-day in the short term doesn’t matter. With this view, I sleep easy at night with no worries about any short-term volatility or lack thereof.

Celebrate the halving and then relax.

Trust the math.

Trust the laws of supply and demand.

Trust historical data.

Trust the effects of the network-effect flywheel.

Trust that Bitcoin will keep mining that next block.

Stack SATs.

The views and opinions expressed here are for entertainment purposes only and should, in no way, be interpreted as financial or investment advice. Always conduct your own research when making an investment or trading decision, as each such move involves risk. The team members behind Triana are not financial advisors and do not claim to be qualified to convey information or advice that a registered financial advisor would convey to clients as guidance. Nothing contained in this e-mail/article constitutes, or shall be construed as, an offering of financial instruments, investment advice, or recommendations of an investment strategy. If you are seeking financial advice, find a professional who is right for you.