The Fiat Mindset Will Only Take You So Far

The world runs on unsound money.

The economies around us operate on systems where the monetary units of exchange are being printed into oblivion.

Instances of hyperinflation aren’t the norm (yet), but they aren’t uncommon to see. Rising inflation isn’t an exception, it is an expected constant reality hurting millions of families globally.

Inflation isn’t a fad when the monetary system you use isn’t backed by a fixed supply of a “hard” asset. Thus, inflation is ever-present in the fiat world.

Since abandoning the Gold Standard in 1971, the United States dollar has lost over 98% of its purchasing power. This is startling considering the US dollar is the global reserve currency—the impact is being felt by all nations.

Countries around the world continuing to use the dollar despite its massive reduction in purchasing power showcases exactly how unsound all of the other currencies in the world are.

If there were a better alternative, surely other countries would use it.

I recognize there are other factors at play. Mainly, the omnipresent United States military that has bases around the world and a global navy traversing the world’s oceans. In the fiat world, the country with the most military might controls the monetary standard of the world.

Living this way, under a constant state of inflation, forces the working class to do more than just save their money for the future. A plumber can no longer stick to being a plumber and expect to retire. A plumber, and anyone else, must attempt to navigate the real estate, stock, and bond markets in an attempt to earn more returns on their investments than the annual inflation devaluing their hard-earned cash.

It becomes a game where you have to earn your money twice; once when you originally are paid, and again when you try to beat inflation.

For many, it’s understandingly overwhelming.

By simply saving your money you lose in the long run due to inflation. By trying to beat inflation you open yourself up to the potential of losing money in your investments.

The fiat way of life, or “fiat mindset,” is the way the world currently works.

The fiat mindset will only take you so far.

I believe this will drastically change in my lifetime.

The world must return to a world of sound money or else it risks inflation and debt running rampant at levels never before seen—I predict we’ll find our way.

Let’s look at Bitcoin.

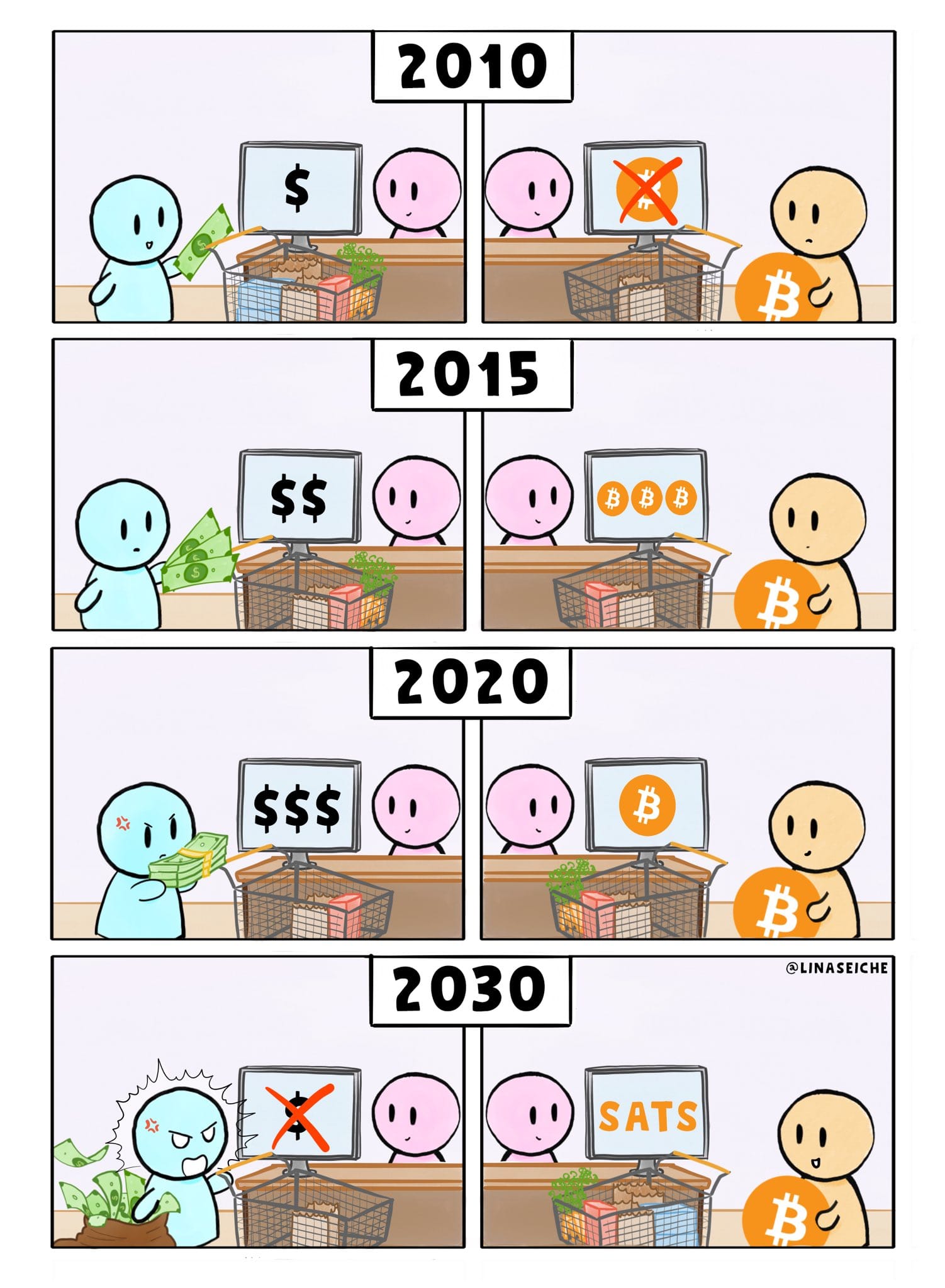

Throughout Bitcoin’s history, the Dollar-to-Bitcoin ratio has evolved significantly.

In the past, one dollar could purchase multiple Bitcoin.

Then one dollar could purchase one Bitcoin.

Then 100 dollars could purchase one Bitcoin.

Then 26,000 dollars… Then 30,000… Now over 47,000 dollars are required for one Bitcoin.

This ratio emphasizes that the dollar’s purchasing power is declining, not only in the world of everyday purchases, but also in the world of Bitcoin. People are waking up to the fact that Bitcoin is an antidote to the poison of inflation that can be trusted to store and hold value.

It’s the strongest money ever created.

If you believe in and understand Bitcoin, there is no other prediction to be made about the future price aside from saying it will go “Up,” because if fiat currencies continue to be printed into the world, the value of Bitcoin will only continue to increase as inflation rises.

But the fiat mindset infects your thinking about Bitcoin. It makes you doubt what you know to be true.

If you know the fiat world is plagued by inflation and the dark clouds of looming hyperinflation, why would you ever swap the hardest asset in the world (circa 2024 halving), for the sickness that is fiat currency?

The fiat mindset pushes you to remain tethered to dollars and other currencies that are bound by nothing more than the “trust” that your government tells you it is worth something.

Fully transitioning beyond the grasp of the fiat mindset opens you up to the sound money that is Bitcoin.

Sound money backed by a decentralized global computing system, proof of work, and a fixed supply.

If you aren’t already, instead of thinking in dollars, think in terms of Bitcoin.

The easiest and simplest game to play is to secure as much Bitcoin as you can.

Trust sound money and move away from the unsound fiat currencies.

The fiat mindset and fiat world will only take you so far. We’re only now beginning to truly witness the global consequences it generates.

Stay calm.

Keep stacking SATs.

The views and opinions expressed here are for entertainment purposes only and should, in no way, be interpreted as financial or investment advice. Always conduct your own research when making an investment or trading decision, as each such move involves risk. The team members behind Triana are not financial advisors and do not claim to be qualified to convey information or advice that a registered financial advisor would convey to clients as guidance. Nothing contained in this e-mail/article constitutes, or shall be construed as, an offering of financial instruments, investment advice, or recommendations of an investment strategy. If you are seeking financial advice, find a professional who is right for you.